Increase Gift Aid income and reduce admin costs

Many charities have embraced Retail Gift Aid and the huge contribution that it can make to income generation. However, this comes with an administrative load, which, whilst warranted for the huge value that Gift Aid can bring, often burdens the retail operation.

With the advent of modern digital solutions, not only can this operational burden be lifted, but charities that adopt the best of them typically achieve more than a 30% increase in their Gift Aid income.

This guide sets out how Digital Gift Aid solutions work, the challenges they address, and the benefits they bring. Whether you are a retailer experienced in the Retail Gift Aid scheme or exploring the potential of Retail Gift Aid for the first time, we hope this guide helps you in some way.

Gift Aid is a tax relief scheme that allows charities to claim 25% on all eligible donations made by a UK taxpayer. For example, if a donor donates ten pounds to the charity, adding Gift Aid will boost the donation by an extra £2.50. Every year, Gift Aid provides charities with over £1 billion of additional income.

More details on Gift Aid can be found here.

Retail Gift Aid is a version of Gift Aid operated by HMRC to allow charities to claim Gift Aid on the sale of donated goods. The difference is that the charity is required to track the goods, and once sold, request permission from the donor for the income raised from the sale to be retained by the charity as a donation. The charity can then claim the Gift Aid on the donation.

More details on Retail Gift Aid can be found here.

Gift Aid is a tax relief scheme that allows charities to claim 25% on all eligible donations made by a UK taxpayer. For example, if a donor donates ten pounds to the charity, adding Gift Aid will boost the donation by an extra £2.50. Every year, Gift Aid provides charities with over £1 billion of additional income.

More details on Gift Aid can be found here.

Donor agreement: When an individual donates goods (such as clothing or books) to a charity shop, they sign both a Gift Aid declaration and an agency agreement. The agency agreement authorises the charity to act as an agent on behalf of the donor (who must be a UK taxpayer) in the sale of their goods.

Selling the goods: The charity shop sells the donated goods recording details of how much it has been sold for along with details of the donor. The commission for the charity being the agent in the sale and the VAT on the commission, is then deducted leaving the net sale proceeds (the amount eligible for Gift Aid to be claimed).

Donor notification: The owner of the donated goods is notified of the net sale proceeds. The owner has the option to keep some or all the proceeds if requested within 21 days, otherwise the net sales proceeds are deemed to have been donated to the charity.

Gift Aid claim: The charity can reclaim the gift aid on the net sale proceeds from HMRC. This adds 25% to the net sale proceeds.

Wanting to take this information away to digest in your own time? That's no problem at all! We've created this guide as a handy PDF for you to download and peruse at your own leisure. Simply fill in your details on this form and your free copy will land in your email inbox shortly after.

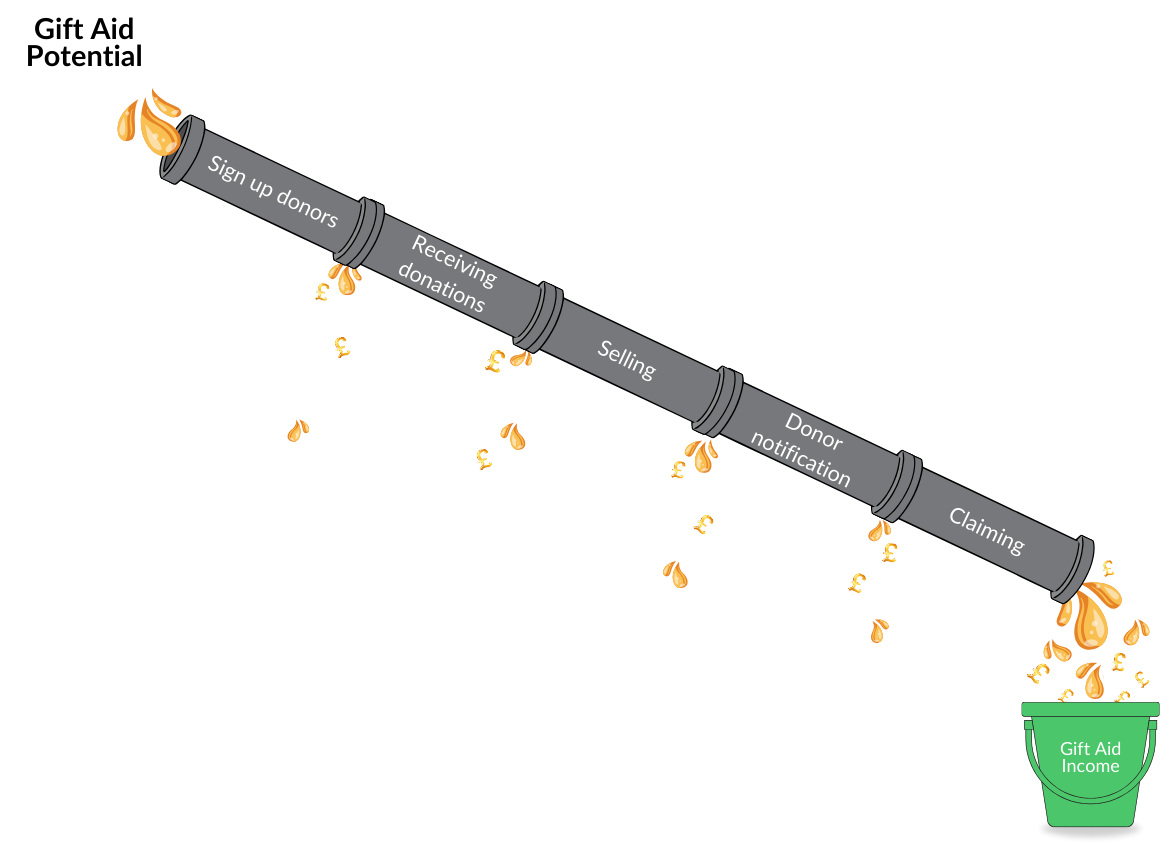

Managing a Retail Gift Aid scheme can deliver a wonderful stream of income for your charity, however, at each stage of the Gift Aid journey, like a leaky pipe, there is an opportunity for some of the potential value of that income to be lost.

The following section looks at each of those stages, the challenges, and the way digital solutions help to solve them to help maximise the income you get from your Retail Gift Aid scheme.

Choosing which type of Gift Aid Method is right for your charity will determine when you need to communicate with your donors. Which method you choose can have a material impact on the costs of administering your scheme. You will need to draw up a suitable agency agreement for your donors that complies with the Gift Aid scheme.

A digital solution will not make this decision for you; however, it will capture and help you enforce the rules and regulations around your decision. A good charity retail solutions partner will help you through this process, for instance with templates for agreements, so that it is easy to understand and straightforward to implement.

Each new donor will need to sign a Gift Aid declaration and agency agreement for your charity to enable you to claim Gift Aid on their donated item(s). Traditionally, paper forms have been used, where the possibility of losing the forms and/or entering information inaccurately on back-office systems can prevent you from being able to claim the Gift Aid. In addition, the forms must be securely stored to comply with GDPR.

Some solutions allow donor sign-up to be undertaken on the till system, but this also has its drawbacks like tying up the one device that takes money from customers and still leaves the considerable issue of mistyped information.

As well as eliminating paper and the back-office processes needed to manage it, a good solution will be simple and intuitive enough to be used by most donors, taking the pressure off your shop team.

A good Digital Gift Aid sign-up solution will...

When a donor returns to the shop, it is crucial that they can be easily identified as a donor and that their donations (or the bags containing them) are labelled with their details. This typically requires the availability of busy shop team members to ask for and capture the information quickly and accurately to ensure the Gift Aid can be claimed down the line.

Some solutions provide donors with tags showing their donor ID or the ability to print labels at home. This helps, but the reality is that these solutions have only limited impact as they rely on donors to remember to prepare in advance of donating.

This is another area where in-shop digital solutions can make a difference. Donor-facing tablet solutions enable donors to find their details and print labels at the point of donation. With good signage in shops encouraging donors to print labels (or ask for help doing so), this vital stage of the Gift Aid value journey can be transformed.

To be able to claim Gift Aid, a donor’s items must be labelled with their donor ID before they go on the shop floor. This ensures the correct details are recorded when the items are sold.

The decision on how to label donated goods is an operational choice that each charity must make.

Many charities label every item, regardless of whether they have a Gift Aid donor ID, ensuring all items are scanned at the point of sale and donor IDs are consistently captured. However, this approach adds an operational overhead as all items must be labelled in the sorting area.

Other charities use different approaches. For example, some label only certain items or no items (except for donor IDs), to reduce the backroom workload, hence relying more on shop teams to ensure consistent scanning of donor barcodes at the point of sale.

Digital solutions can assist by offering highly flexible labelling options, enabling you to include several details in a single barcode. This allows your charity to select the labelling model that suits your operation and to adapt and experiment as required to find the best fit.

A flexible Digital Gift Aid solution will permit any or all of the following details in a barcode...

The key is having a solution that offers enough flexibility for you to discover and implement the optimum approach for your shops.

Communicating with donors at a frequency determined by the selected Gift Aid method is a potentially time-consuming process.

Traditionally, this has involved large mail runs and envelope-stuffing exercises. The human resources required for this process put a burden on your charity and often result in delays in claiming Gift Aid.

The good news is that HMRC’s rules around communication are very clear and following rules is what computer systems do best.

A good modern Digital Gift Aid solution can do all of this automatically...

Create notifications for your donors following the Gift Aid Method rules

Send emails to donors

Send letters (when no email details are available) via a mailing service

Apply separate rules for email and letter communications so that:

Building the claim requires you to obtain the donor information along with the net sales proceeds and build the spreadsheet in the format that the HMRC requires to submit the claim. Once this is ready it must be submitted to HMRC via the HMRC portal (Charities Online).

Any inaccurate or incomplete information submitted for any of the donors will result in the whole claim being rejected by HMRC. This will require you to either remove or correct each donor before resubmitting, which can often be a recurring exercise to get a claim accepted.

With a modern Digital Gift Aid solution, this entire process can be automated, allowing you to submit a claim and have it accepted with a single click.

Whereas there isn’t a solution that can automatically clean the data for you, they can point out donor details that need attention and automatically remove them from the claim to allow the claim to go through. Then, once remedied they can be included in the next claim.

What is the impact? Charities that have adopted modern Digital Gift Aid solutions have typically removed the administration load and have increased the frequency of their Gift Aid claims from quarterly or six monthly to monthly or even weekly claims.

The introduction of a modern highly automated Gift Aid solution can be transformative as it:

When looking to streamline your Retail Gift Aid claims, your priority should be to partner with an experienced supplier who can advise you on the most suitable solution for your needs. If your chosen system is easy to use and effective, you should be able to operate it seamlessly.

We have spent the last 6 years dedicating ourselves to transforming the Retail Gift Aid journey for charities with the expressed goal of maximising Gift Aid and minimising admin.

We have innovated at every stage to improve your Gift Aid, typically by over 30%, whilst eliminating nearly all of the admin.

To enquire about joining the Wil-U Family today, click here.

HMRC outlines guidelines on when and how communication with donors should occur to claim the Gift Aid. We've developed a fully automated system that ensures you comply with these rules. It even saves you from having to print and send letters through our automated mailing service. Bid farewell to envelope stuffing (except for Christmas cards!)

.png?width=107&height=126&name=Untitled%20design%20(61).png)